cryptocurrency tax calculator ireland

Cryptocurrency tax software calculates whether the crypto you are selling was held long or short term. See Taxation of cryptocurrency transactions for guidance on the tax treatment of various transactions involving cryptocurrencies.

Koinly Review May 2022 Cryptocurrency Tax Made Easy Yore Oyster

Irish citizens have to report their capital gains from cryptocurrencies.

. Taxation of cryptocurrency transactions. Enter the sale date and sale price. This means that profits from crypto transactions are subject to capital gains tax at 33 at the time of disposal of the crypto.

Make sure the sale date is within the tax year selected. In Ireland cryptocurrency investments are subject to the same regulations as investments in stocks and shares. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Capital gains tax report. Document created in May 2018. That is the profits from trading will be taxable under Income Tax rules.

Fortunately the first 1270 of your cumulative annual gains after deducting expenses and losses from other cryptocurrency investments further details below are exempt from tax. Direct tax treatment of cryptocurrencies. This means that profits from crypto transactions are subject to capital gains tax at.

Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins. Repeat for all Bitcoin or cryptocurrency sales within the tax year selected. In Ireland cryptocurrency investments are subject to the same regulations as investments in stocks and shares.

With TaxCalc you will be able to see a breakdown of all your deductions from your gross pay and estimate how much a pay increase or deduction is going to impact on your. If you are dealing in cryptocurrencies you need to make a declaration to Revenue even if you. Bitcointax is the leading capital gains and income tax calculator for Bitcoin Ethereum Ripple and other digital currencies.

If you dont want to use a tax calculator for whatever reason you have. Binance coin bnb 646. The resulting number is your cost basis 10000 1000 10.

But any profit that you make above this figure will be taxed at 33 and you will need to file a tax return each year. Deposits can be made through bank transfer SEPA transfer international bank wire and now even credit cards. Extract from Revenueie click here for source document.

Cryptocurrency Tax Calculator Alternatives. The tax treatments outlined in this manual are for tax. The purpose of this manual is to give guidance on the tax treatment of various transactions involving cryptocurrencies.

Koinly is an online crypto tax platform that allows you to monitor all your crypto activities and generate regulatory compliant tax reports. 16 December 2021 Please rate how useful this page was to you Print this page. Heres an example of how to calculate the cost basis of your cryptocurrency.

Ireland operates a self-assessment system of taxation. March 29 2018. This means you can get your books up to date yourself allowing you to save significant time.

As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. The purchase date can be any time up to December 31st of the tax year selected. Very low 025 fee falling to 01 with sufficient trading volume.

The tax due for this period must be paid on or before 31 January of the following year. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto. Coinpanda lets Irish citizens calculate their capital gains with ease.

In Ireland crypto investments are treated just like investments in stocks or shares. Irelands Revenue states that profits and losses of a non-incorporated business on cryptocurrency transactions must be reflected in their accounts and will be taxable on normal income tax rules. Coinpanda generates ready-to-file forms based on your trading activity in less than 20.

Since then its developers have been creating native apps for mobile devices and other upgrades. PRSI PAYE and USC Will apply at the. Revenues view is that an investment in cryptocurrency is the same as a share investment and accordingly should be subject to Capital Gains Tax at 33.

There are no special tax rules for cryptocurrencies. Generate ready-to-file tax forms including tax reports for Forks Mining Staking. The deadline for filing CGT is at the end of this month.

Use code BFCM25 for 25 off on your purchase. One of the longest-running Bitcoin exchanges. You simply import all your transaction history and export your report.

Enter the purchase date and purchase price. Therefore individuals that are trading in cryptocurrency are required to file an income tax return Form 11 or Form 12 each year and declare profits made on trading. What is cryptocurrency accounting software.

Take the initial investment amount lets assume it is 1000. Crypto tax software ireland. The original software debuted in 2014.

Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. This means that the responsibility for registering for the appropriate tax identifying and paying the correct tax due and the ultimate filing of a return rests with the taxpayer. BitStamp is one of the worlds largest and most well-known Bitcoin exchanges.

CoinTrackinginfo - the most popular crypto tax calculator. Back to homepage Back to top. While cryptocurrencies are not legal tender in Ireland an investment in them is subject to taxation.

2022 2021 Income Tax Calculator TaxCalc allows you to estimate your take home pay based on your total pay pension contribution and personal circumstances. In other words if youre making profits or losses through the disposal of your cryptocurrency whether by selling gifting or exchanging you need to pay a 33 Capital Gains Tax CGT. In Ireland income tax on crypto activities typically involves getting Paid in Crypto accepting crypto for payment of goods and services airdrops signup referral.

Bitcoin Taxes has provided services to consumers and tax professionals since its launch in 2014. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. In this article we go over the main features of a cryptocurrency tax calculator.

As with any other activity the treatment of income received from charges made in connection with activities involving cryptocurrencies will depend on the activities and the parties involved. The direct taxes are corporation tax income tax and capital gains tax. Automate your crypto tax calculation with the best Bitcoin tax calculator.

The profits will be subject to normal income tax rules ie.

Enron Gordon Gekko Of The 2000 S 2000s Bear Market Chart

Investicii S Gazprom V 2022 G Prilozheniya Deyatelnost Znanie

Download Pan Card Online Forms To Apply Pan Card In India Application Form Application Form

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

Tax Preparation Tax Help Cryptocurrency Tax Return

پیش بینی جهش قیمت بیت کوین در سال 2019 اریک الیوت در این مقاله ادعا دارد که با قرار دادن روندهای مختلف رو به رشد ارز Bitcoin Cryptocurrency Capital Gains Tax

Calculating Your Crypto Taxes What You Need To Know

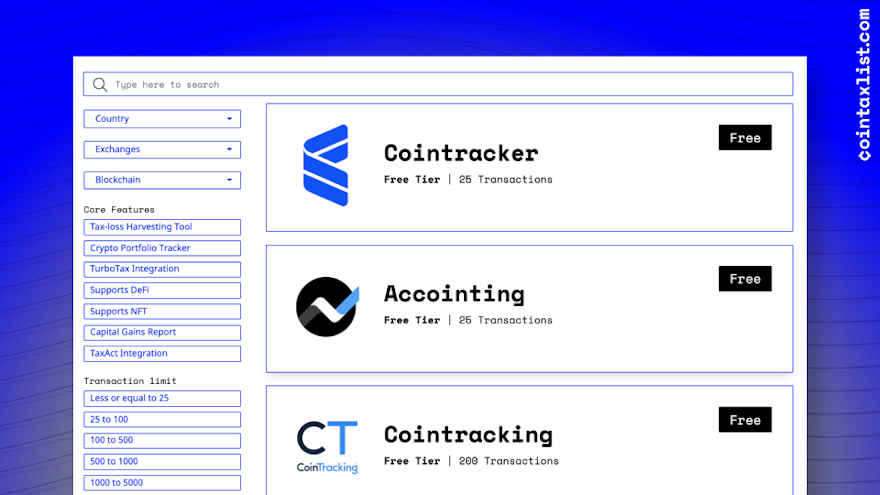

Find The Best Crypto Tax Software For Your Needs

Ultimate Bitcoin Tax Guide 2022 Koinly Crypto Tax

Ireland Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Crypto Tax Calculator Doing Your Crypto Taxes Has Never Been Easier Boinnex

Ireland Cryptocurrency Tax Guide 2021 Koinly

Mistakes Made By Payroll Companies

Google Bans Cryptocurrency Mining Apps From Play Store Google Play Store Cryptocurrency App

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

A Growing Number Of Hotels Around The World Particularly In The Uk And Ireland Are Now Accepting International Money Tr Money Transfer Send Money Payday Loans